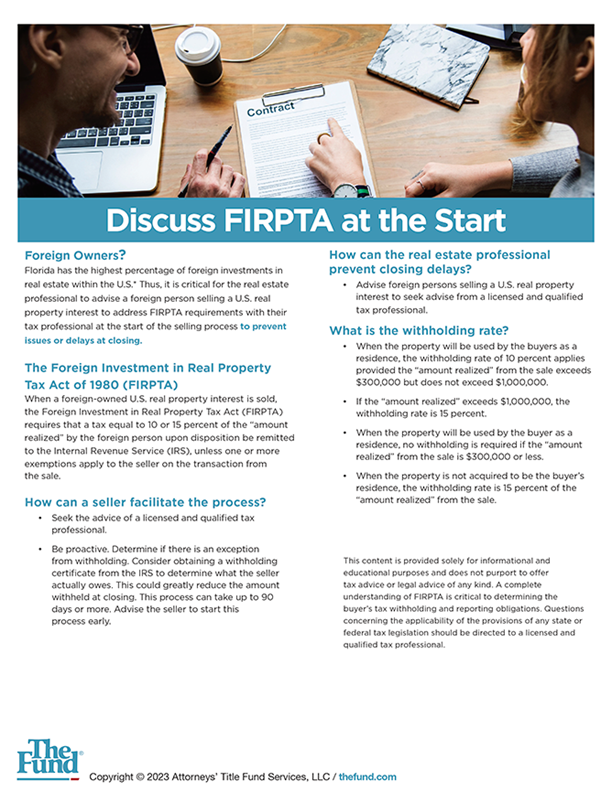

Discuss FIRPTA at the Start – Realtor

Florida has the highest percentage of foreign investments in real estate within the U.S. Real estate professionals need to advise a foreign person selling a U.S. real property to address the Foreign Investment in Real Property Tax Act (FIRPTA) requirements with their tax professional at the start of the selling process to prevent issues or delays at closing. This helpful handout explains FIRPTA and how real estate professionals can help foreign owners navigate this process smoothly.

Printed Format

- Sold in sets of 25

- Produced through Fund Prints and Shipped Directly to You!

- Personalized with Your Contact Information

Print Shop

Place your order online! Many items can be personalized with your business logo and contact information. Graphic design and mailing services are available as well. Contact us for further assistance.

Toll Free:1-800-336-3863

Direct:407-240-2950

printshop@thefund.com